library(tidyverse) # for data wrangling

library(alr4) # for the data sets #

library(GGally)

library(ggpmisc)

library(parameters)

library(performance)

library(see)

library(car)

library(broom)

library(modelsummary)

library(texreg)

ggplot2::theme_set(ggplot2::theme_bw())

knitr::opts_chunk$set(

fig.width = 12,

fig.asp = 0.618,

fig.retina = 3,

dpi = 300,

out.width = "100%",

message = FALSE,

echo = TRUE,

cache = TRUE

)

my_gof <- function(fit_obj, digits = 4) {

sum_fit <- summary(fit_obj)

stars <-

pf(sum_fit$fstatistic[1],

sum_fit$fstatistic[2],

sum_fit$fstatistic[3],

lower.tail=FALSE) %>%

symnum(corr = FALSE, na = FALSE,

cutpoints = c(0, .001,.01,.05, 1),

symbols = c("***","**","*"," ")) %>%

as.character()

list(

# `R^2` = sum_fit$r.squared %>% round(digits),

# `Adj. R^2` = sum_fit$adj.r.squared %>% round(digits),

# `Num. obs.` = sum_fit$residuals %>% length(),

`Num. df` = sum_fit$df[[2]],

`F statistic` =

str_c(sum_fit$fstatistic[1] %>% round(digits), " ", stars)

)

}

screen_many_regs <-

function(fit_obj_list, ..., digits = 4, single.row = TRUE) {

if (class(fit_obj_list) == "lm")

fit_obj_list <- list(fit_obj_list)

if (length(rlang::dots_list(...)) > 0)

fit_obj_list <- fit_obj_list %>% append(rlang::dots_list(...))

# browser()

fit_obj_list %>%

screenreg(

custom.note =

map2_chr(., seq_along(.), ~ {

str_c("Model ", .y, " ", as.character(.x$call)[[2]])

}) %>%

c("*** p < 0.001; ** p < 0.01; * p < 0.05", .) %>%

str_c(collapse = "\n") ,

digits = digits,

single.row = single.row,

custom.gof.rows =

map(., ~my_gof(.x, digits)) %>%

transpose() %>%

map(unlist),

reorder.gof = c(3, 4, 5, 1, 2)

)

}Linearity

MP223 - Applied Econometrics Methods for the Social Sciences

Eduard Bukin

R setup

Linearity

Linearity: meaning

the expected value of dependent variable is a straight-line function of the independent variable

If linearity is violated:

- bias of our estimates

- inappropriate representation of the dependent variable

Linearity: detection

How to detect a non-linearity?

- no accepted statistical tests, but

- less known Tukey test

- visual inspection

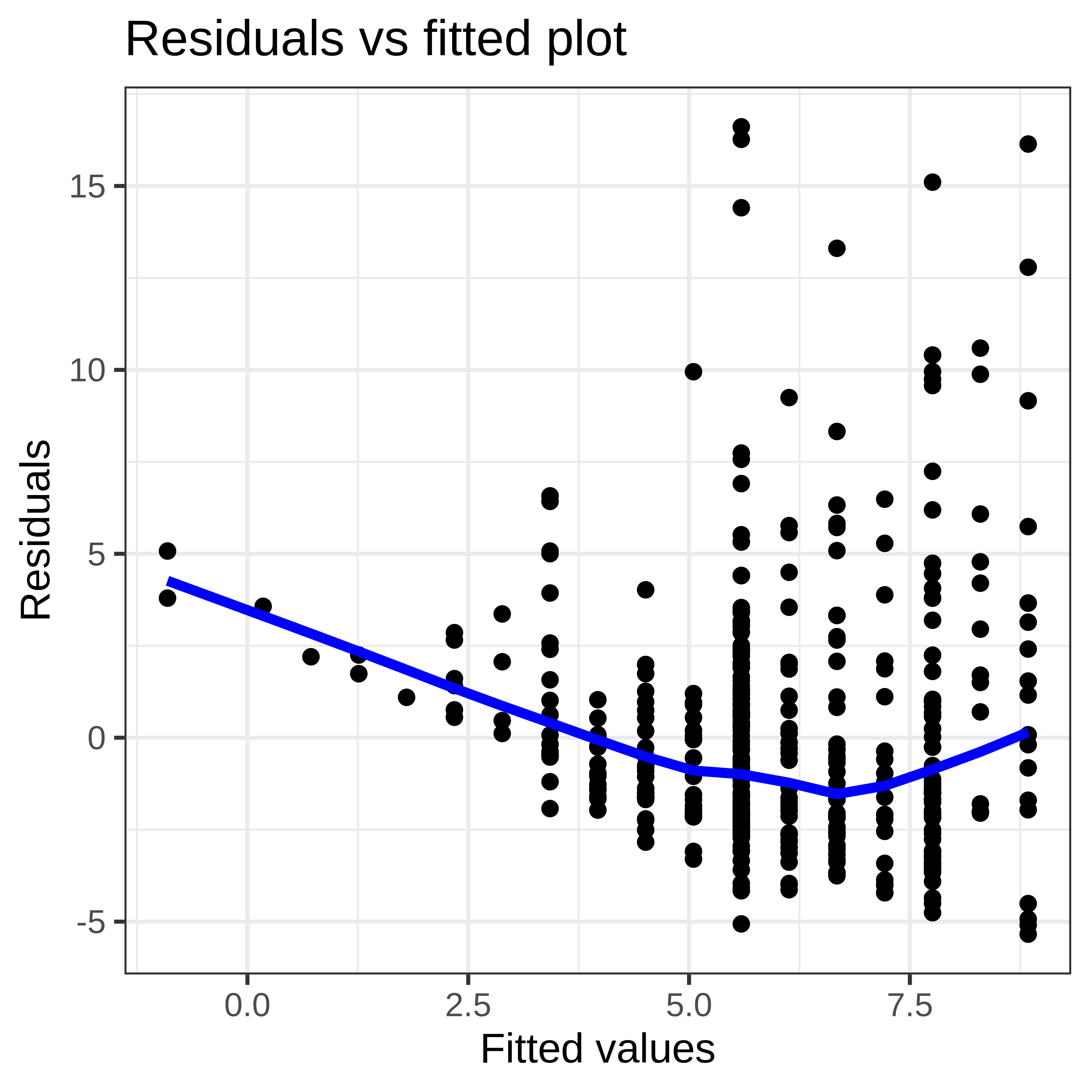

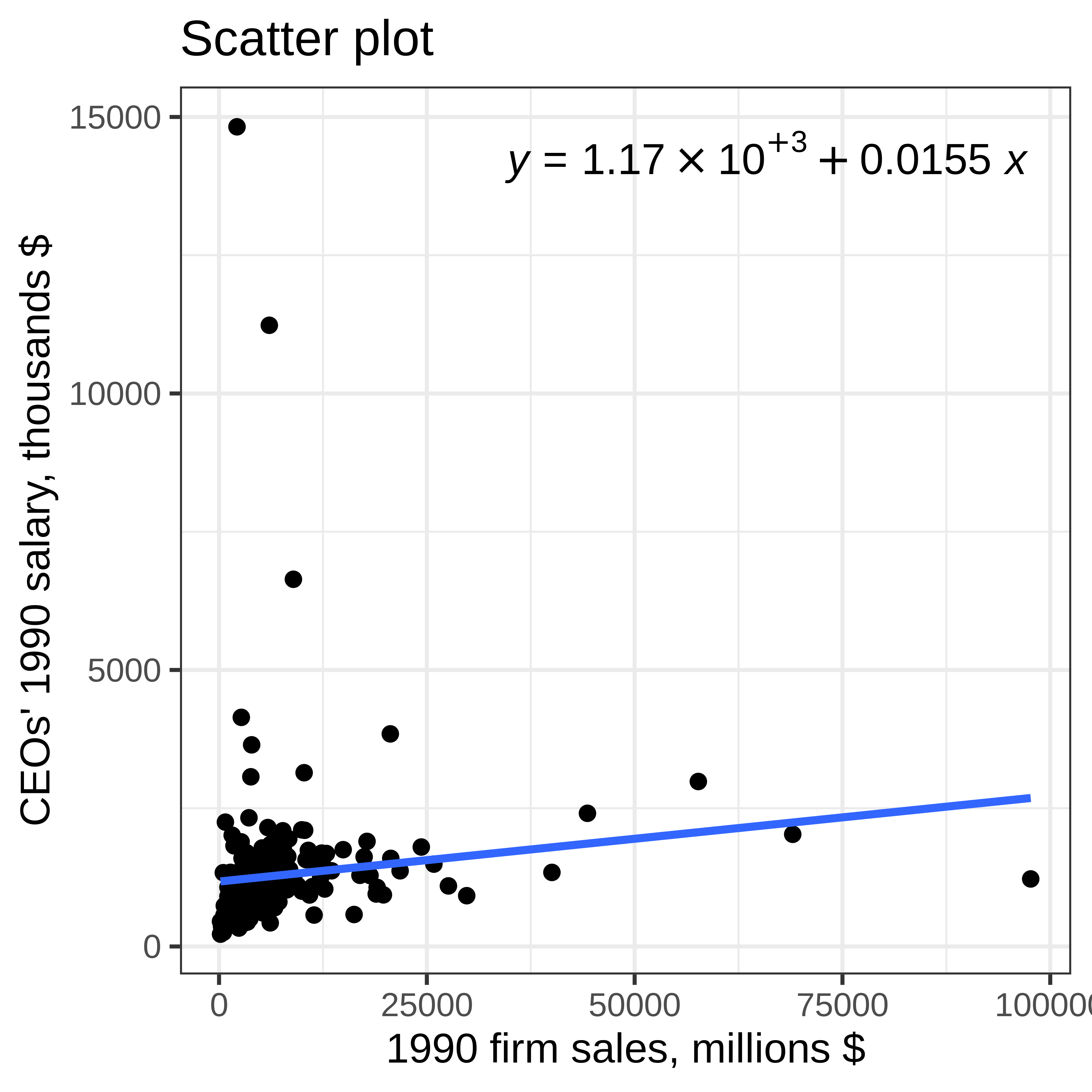

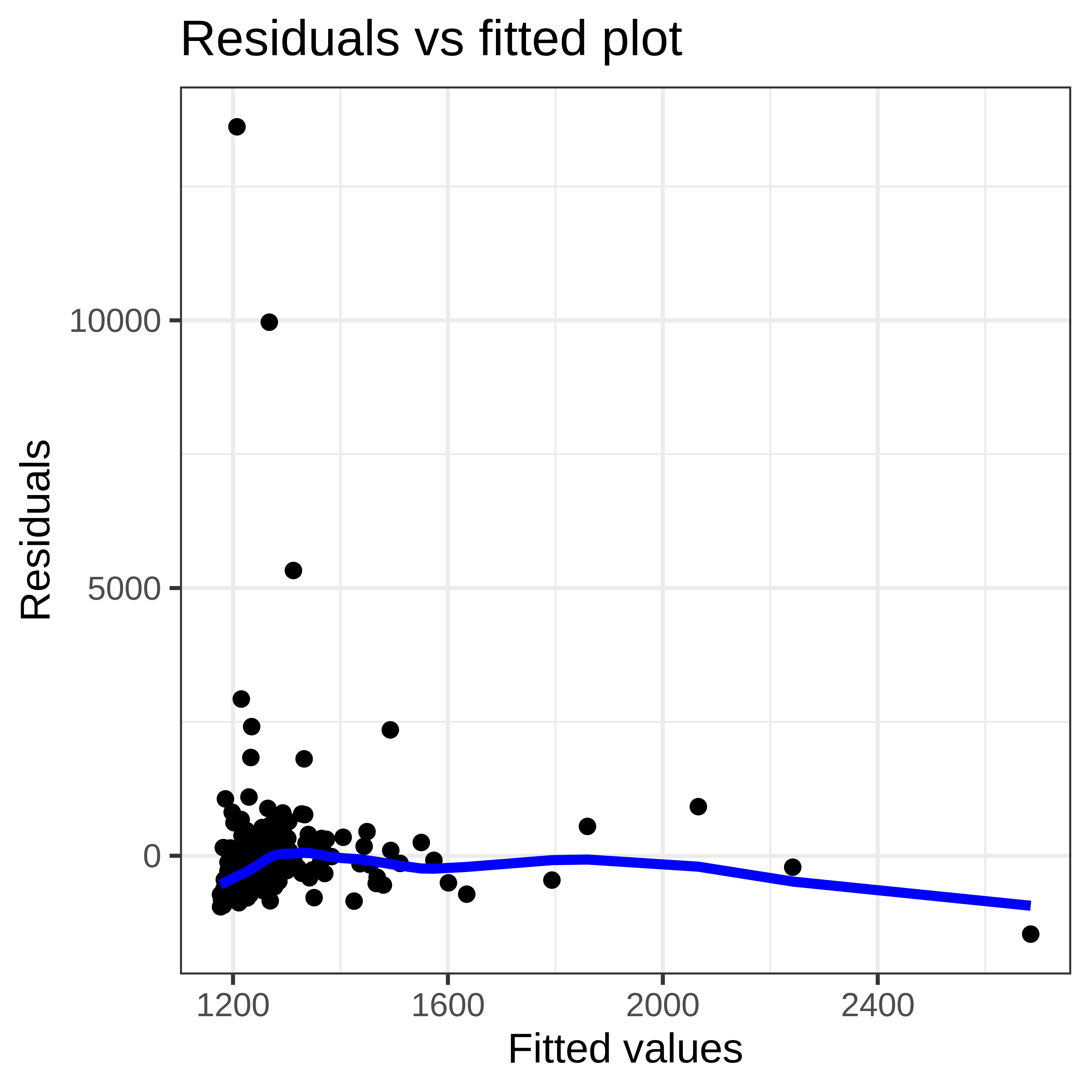

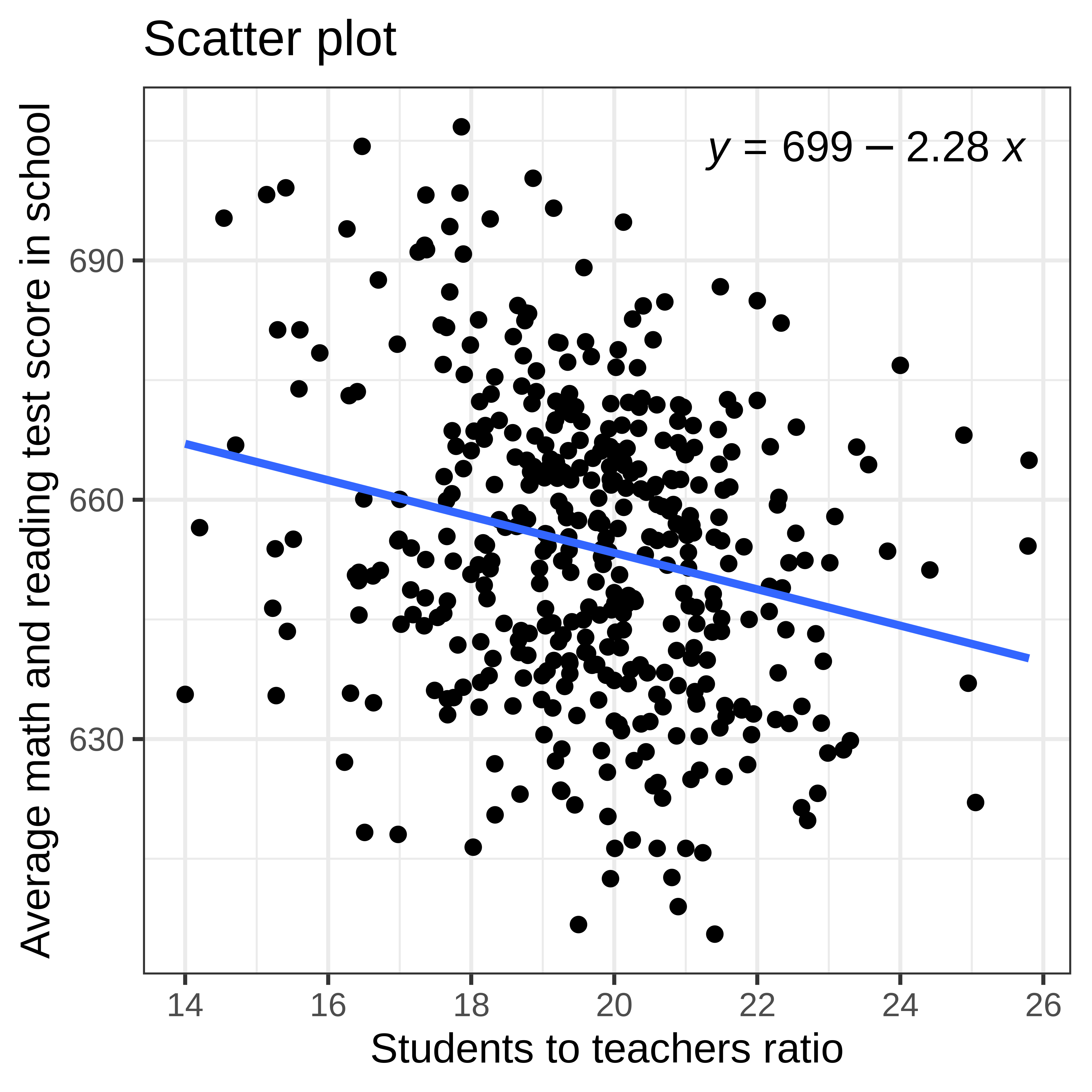

Typical plots:

- Scatter plots of dependent and independent variables;

- observed versus predicted/fitted values;

- residuals versus predicted/fitted values;

Linearity: resolutions

(non) linear transformation to the dependent and/or independent variables;

- it does change the way how we must interpret coefficients;

find a different independent variable;

propose a different functional form;

Common linear transformations

Power transformation or Box-Cox transformations;

Variables normalization to the standard normal distribution;

Tailor expansion (Cobb-Douglas, Trans-log)

Examples

Example 1: Anscombe quartet

Descriptive statistics

Four data sets each of 11 observations and two variables (x and y).

Descriptive statistics:

Code

anscombe %>%

mutate(id = row_number()) %>%

pivot_longer(c(contains("x"), contains("y")), names_to = "Variables") %>%

mutate(`Data set` = str_extract(Variables, "\\d"),

Variables = str_remove(Variables, "\\d")) %>%

pivot_wider(names_from = Variables, values_from = value) %>%

group_by(`Data set`) %>%

summarise(across(c(x, y), ~ mean(.), .names = "mean_{.col}"),

across(c(x, y), ~ sd(.), .names = "sd_{.col}"))# A tibble: 4 × 5

`Data set` mean_x mean_y sd_x sd_y

<chr> <dbl> <dbl> <dbl> <dbl>

1 1 9 7.50 3.32 2.03

2 2 9 7.50 3.32 2.03

3 3 9 7.5 3.32 2.03

4 4 9 7.50 3.32 2.03Simple regressions of y on x

# A tibble: 8 × 6

`Data set` term estimate std.error statistic p.value

<chr> <chr> <dbl> <dbl> <dbl> <dbl>

1 Data set 1 (Intercept) 3.00 1.12 2.67 0.0257

2 Data set 1 x 0.500 0.118 4.24 0.00217

3 Data set 2 (Intercept) 3.00 1.13 2.67 0.0258

4 Data set 2 x 0.5 0.118 4.24 0.00218

5 Data set 3 (Intercept) 3.00 1.12 2.67 0.0256

6 Data set 3 x 0.500 0.118 4.24 0.00218

7 Data set 4 (Intercept) 3.00 1.12 2.67 0.0256

8 Data set 4 x 0.500 0.118 4.24 0.00216Scatter plots

Code

fig_norm_anscombe <-

norm_anscombe %>%

mutate(data_sample = str_c("Data set ", data_sample))

fig_norm_anscombe %>%

ggplot() +

aes(x, y, group = data_sample) +

geom_point() +

geom_smooth(

data = filter(fig_norm_anscombe, data_sample == "Model 2"),

method = "lm",

formula = y ~ x + I(x ^ 2)

) +

geom_smooth(

data = filter(fig_norm_anscombe,

data_sample == "Model 3", y < 11)

) +

geom_abline(slope = 0.5, intercept = 3, colour = "red") +

theme_bw() + facet_wrap(. ~ data_sample)

Residuals vs fitted

Example 2: Wage and Education

Example 3: Sales and CEO salary

Example 4: Acceptable linearity

Example 5: Fuel taxes influence on fuel consumption?

As a federal policy maker, we would like to understand how fuel taxes were affecting the gasoline consumption across the states.

We use data on fuel consumption in 2001 across all states in the USA (each observation represents a state). Data from (weisberg2013a?).

Variables present in the data are:

- \(\text{Tax}\) : Gasoline state tax rate, cents per gallon;

- \(\text{Dlic}\) : The number of licensed drivers per 1000 population over the age of 16;;

- \(\text{Income}\) : in 1000 USD Per capita personal income (year 2000);

- \(\text{Miles}\) : Miles of Federal-aid highway miles in the state;

- \(\text{Fuel}\) : Gasoline consumption per capita (gal.);

Empirical model and ex-ante expectations

Regression equation:

- \(\text{Fuel} = \hat\beta_0 + \hat\beta_1 \cdot \text{Tax} + \hat\beta_2 \cdot \text{Dlic} \\ + \hat\beta_3 \cdot \text{Income} + \hat\beta_4 \cdot \text{Miles} + \hat{u}\)

What could be expected values of the coefficients?

Data

Code

Rows: 51

Columns: 5

$ Tax <dbl> 18.0, 8.0, 18.0, 21.7, 18.0, 22.0, 25.0, 23.0, 20.0, 13.6, 7.5,…

$ Dlic <dbl> 1031.3801, 1031.6411, 908.5972, 946.5706, 844.7033, 989.6062, 9…

$ Income <dbl> 23.471, 30.064, 25.578, 22.257, 32.275, 32.949, 40.640, 31.255,…

$ Miles <int> 94440, 13628, 55245, 98132, 168771, 85854, 20910, 5814, 1534, 1…

$ Fuel <dbl> 690.2644, 514.2792, 621.4751, 655.2927, 573.9129, 616.6115, 549…Descriptive statistics

Unique (#) Missing (%) Mean SD Min Median Max

1 Tax 31 0 20.2 4.5 7.5 20.0 29.0

2 Dlic 51 0 903.7 72.9 700.2 909.1 1075.3

3 Income 51 0 28.4 4.5 21.0 27.9 40.6

4 Miles 51 0 77418.6 52983.4 1534.0 78914.0 300767.0

5 Fuel 51 0 613.1 89.0 317.5 626.0 842.8Data visualization

Regression

Parameter | Coefficient | SE | 95% CI | t(46) | p

------------------------------------------------------------------------

(Intercept) | 383.96 | 165.75 | [ 50.32, 717.60] | 2.32 | 0.025

Tax | -4.11 | 2.11 | [ -8.36, 0.13] | -1.95 | 0.057

Dlic | 0.54 | 0.14 | [ 0.26, 0.81] | 3.90 | < .001

Income | -7.14 | 2.21 | [-11.58, -2.70] | -3.24 | 0.002

Miles | 4.02e-04 | 1.87e-04 | [ 0.00, 0.00] | 2.14 | 0.037 # Indices of model performance

AIC | BIC | R2 | R2 (adj.) | RMSE | Sigma

-------------------------------------------------------

580.602 | 592.193 | 0.476 | 0.430 | 63.790 | 67.167Testing linearity (1/3)

Testing linearity (2/3)

Testing linearity (3/3)

Test stat Pr(>|Test stat|)

Tax -1.1363 0.26183

Dlic -2.4859 0.01670 *

Income 0.0500 0.96036

Miles -0.2036 0.83961

Tukey test -2.3136 0.02069 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Re-fitting regressions

Parameter | Coefficient | SE | 95% CI | t(46) | p

-----------------------------------------------------------------------

(Intercept) | 154.19 | 194.91 | [-238.13, 546.52] | 0.79 | 0.433

Tax | -4.23 | 2.03 | [ -8.31, -0.14] | -2.08 | 0.043

Dlic | 0.47 | 0.13 | [ 0.21, 0.73] | 3.67 | < .001

Income | -6.14 | 2.19 | [ -10.55, -1.72] | -2.80 | 0.008

Miles [log] | 26.76 | 9.34 | [ 7.96, 45.55] | 2.87 | 0.006 # Indices of model performance

AIC | BIC | R2 | R2 (adj.) | RMSE | Sigma

-------------------------------------------------------

577.086 | 588.677 | 0.510 | 0.468 | 61.628 | 64.891Checking linearity (1/2)

Checking linearity (2/2)

Test stat Pr(>|Test stat|)

Tax -1.0767 0.28737

Dlic -1.9219 0.06096 .

Income -0.0840 0.93345

log(Miles) -1.3473 0.18463

Tukey test -1.4460 0.14818

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Interpreting the results

=============================================================

Model 1 Model 2

-------------------------------------------------------------

(Intercept) 383.9594 (165.7522) * 154.1928 (194.9062)

Tax -4.1145 (2.1073) -4.2280 (2.0301) *

Dlic 0.5353 (0.1373) *** 0.4719 (0.1285) ***

Income -7.1375 (2.2054) ** -6.1353 (2.1936) **

Miles 0.0004 (0.0002) *

log(Miles) 26.7552 (9.3374) **

-------------------------------------------------------------

R^2 0.4755 0.5105

Adj. R^2 0.4299 0.4679

Num. obs. 51 51

Num. df 46 46

F statistic 10.4272 *** 11.9924 ***

=============================================================

*** p < 0.001; ** p < 0.01; * p < 0.05

Model 1 Fuel ~ Tax + Dlic + Income + Miles

Model 2 Fuel ~ Tax + Dlic + Income + log(Miles)Application Exercise

ae04-02-MLR-linearity.Rmd

Takeaways

Linearity assumption

Diagnostics of the linearity

Linear transformations

References