library(tidyverse)

library(readr) # install.packages("readr")

library(readxl) # install.packages("readxl")

library(janitor) # install.packages("janitor")

library(skimr) # install.packages("skimr")

library(lubridate) # install.packages("lubridate")

ggplot2::theme_set(ggplot2::theme_minimal())

knitr::opts_chunk$set(out.width = 60)AE03-03 Correlation

Setups

Data import and cleaning

Importing and cleaning data in the wide format

Practically the same procedure that we did in the previous exercise.

p_wd <-

read_excel("data/commodity-prices.xlsx", sheet = "data") %>%

clean_names() %>%

rename(wheat = soft_red_winter_wheat_no_2_f_o_b_us_gulf_usd_per_mt,

maize = yellow_maize_no_2_f_o_b_us_gulf_usd_per_mt,

date = day_month_year,

oil = crude_oil_brent_usd_per_barrel,

urea = urea_f_o_b_black_sea_usd_per_mt) %>%

slice(-1) %>%

mutate(

oil = as.numeric(oil),

wheat = as.numeric(wheat),

maize = as.numeric(maize),

urea = as.numeric(urea),

date = convert_to_date(date)

)

glimpse(p_wd)Rows: 359

Columns: 5

$ date <date> 1992-03-01, 1992-04-01, 1992-05-01, 1992-06-01, 1992-07-01, 199…

$ oil <dbl> 17.45, 18.63, 19.50, 20.83, 20.17, 19.62, 20.15, 20.08, 18.88, 1…

$ wheat <dbl> 161.44, 153.07, 139.72, 140.36, 129.93, 118.80, 131.47, 137.42, …

$ maize <dbl> 117.00, 108.52, 109.64, 110.90, 102.75, 96.96, 98.05, 95.11, 94.…

$ urea <dbl> 120.00, 120.00, 120.00, 120.00, 120.00, 120.00, 120.00, 116.88, …Converting data to the long format

p_lg <-

p_wd %>%

pivot_longer(cols = c(oil:urea),

names_to = "var",

values_to = "price") %>%

arrange(date, var)

glimpse(p_lg)Rows: 1,436

Columns: 3

$ date <date> 1992-03-01, 1992-03-01, 1992-03-01, 1992-03-01, 1992-04-01, 199…

$ var <chr> "maize", "oil", "urea", "wheat", "maize", "oil", "urea", "wheat"…

$ price <dbl> 117.00, 17.45, 120.00, 161.44, 108.52, 18.63, 120.00, 153.07, 10…Example: Computing prices index with some base

Index of a variable with a base is a mathematical transformation of a variable, where each value of a variable is divided by the base value and then multiplied by 100.

\[ {I}_{i} = \frac{x_i}{x_{base}} \times 100 \]

This is easy in Excel, but tricky without it!

Let us demonstrate the logic of calculations based on a simple example of 2 commodities (wheat and urea) and few month in year 2010.

Step 1. Filter a sub-sample

As discussed above, we want to:

filter data, where year is 2010, month less than 6, var is "wheat" or "maize"

Which identically translate into R code as:

filter(data, year(date) == 2010, month(date) < 6, var %in% c("wheat", "maize"))`filter data, where year is 2010, month less than 6, var is "wheat" or "maize"

p_lg_sb <-

filter(p_lg,

year(date) == 2010,

month(date) < 6,

var %in% c("wheat", "maize")) %>%

arrange(var, date)

p_lg_sb# A tibble: 10 × 3

date var price

<date> <chr> <dbl>

1 2010-01-01 maize 167.

2 2010-02-01 maize 162.

3 2010-03-01 maize 159.

4 2010-04-01 maize 157.

5 2010-05-01 maize 163.

6 2010-01-01 wheat 199.

7 2010-02-01 wheat 192.

8 2010-03-01 wheat 190.

9 2010-04-01 wheat 188.

10 2010-05-01 wheat 190.Step 2. Create variable with the base for indexing

Here we want to:

for each groups of commodities "var", mutate variable "base", which is equal to "price" when month is equal to 1 and year is equal to 2010.

In language of R this is:

p_lg_sb %>%

group_by(var) %>% # 1. for each groups of commodities "var"

mutate( # 2. mutate

base = ifelse( # 3. variable "base", which is equal to

month(date) == 1 & # 5. when month is equal to 1 and

year(date) == 2010, # 6. year is equal to 2010

price, # 4. "price"

NA # 7. missing value is in other cases

)

)# A tibble: 10 × 4

# Groups: var [2]

date var price base

<date> <chr> <dbl> <dbl>

1 2010-01-01 maize 167. 167.

2 2010-02-01 maize 162. NA

3 2010-03-01 maize 159. NA

4 2010-04-01 maize 157. NA

5 2010-05-01 maize 163. NA

6 2010-01-01 wheat 199. 199.

7 2010-02-01 wheat 192. NA

8 2010-03-01 wheat 190. NA

9 2010-04-01 wheat 188. NA

10 2010-05-01 wheat 190. NA Step 3. Make sure that base is the same for all observations in each group var

p_lg_sb %>%

group_by(var) %>%

mutate(base = ifelse(month(date) == 1 & year(date) == 2010, price, NA)) %>%

tidyr::fill(base, .direction = "updown")# A tibble: 10 × 4

# Groups: var [2]

date var price base

<date> <chr> <dbl> <dbl>

1 2010-01-01 maize 167. 167.

2 2010-02-01 maize 162. 167.

3 2010-03-01 maize 159. 167.

4 2010-04-01 maize 157. 167.

5 2010-05-01 maize 163. 167.

6 2010-01-01 wheat 199. 199.

7 2010-02-01 wheat 192. 199.

8 2010-03-01 wheat 190. 199.

9 2010-04-01 wheat 188. 199.

10 2010-05-01 wheat 190. 199.Step 4. Calculate index

p_lg_sb %>%

group_by(var) %>%

mutate(base = ifelse(month(date) == 1 & year(date) == 2010, price, NA)) %>%

tidyr::fill(base, .direction = "updown") %>%

mutate(index = price / base * 100)# A tibble: 10 × 5

# Groups: var [2]

date var price base index

<date> <chr> <dbl> <dbl> <dbl>

1 2010-01-01 maize 167. 167. 100

2 2010-02-01 maize 162. 167. 96.7

3 2010-03-01 maize 159. 167. 95.1

4 2010-04-01 maize 157. 167. 93.9

5 2010-05-01 maize 163. 167. 97.7

6 2010-01-01 wheat 199. 199. 100

7 2010-02-01 wheat 192. 199. 96.5

8 2010-03-01 wheat 190. 199. 95.6

9 2010-04-01 wheat 188. 199. 94.5

10 2010-05-01 wheat 190. 199. 95.7Optional example: calculate index, where base is average of month 2 and 3

p_lg_sb %>%

group_by(var) %>%

mutate(base = ifelse(month(date) %in% c(2,3) &

year(date) == 2010,

price,

NA)) %>%

mutate(base_full = mean(base, na.rm = TRUE)) %>%

mutate(index = price / base_full * 100)# A tibble: 10 × 6

# Groups: var [2]

date var price base base_full index

<date> <chr> <dbl> <dbl> <dbl> <dbl>

1 2010-01-01 maize 167. NA 160. 104.

2 2010-02-01 maize 162. 162. 160. 101.

3 2010-03-01 maize 159. 159. 160. 99.1

4 2010-04-01 maize 157. NA 160. 97.9

5 2010-05-01 maize 163. NA 160. 102.

6 2010-01-01 wheat 199. NA 191. 104.

7 2010-02-01 wheat 192. 192. 191. 100.

8 2010-03-01 wheat 190. 190. 191. 99.5

9 2010-04-01 wheat 188. NA 191. 98.4

10 2010-05-01 wheat 190. NA 191. 99.7Note, we specify mean(…, na.rm = TRUE) because when we compute mean, there are some missing observations in the variable. Mean of a vector with missing observation will return NA.

mean(c(1, 2, 3, 4, NA))[1] NAIf we specify parameter to ignore NA in the data, we will get a result:

mean(c(1, 2, 3, 4, NA), na.rm = TRUE)[1] 2.5Exercise 1. Compute prices index with base mean prices in 2010

Following the previous examples, let us compute:

- Step 1. for each group of

var; - Step 2. mutate

base_part, which containspriceifyearis 2010 andNAin else cases; - Step 3. mutate

basewith themean()value ofbase_partprice with parameterna.rm = TRUE; - Step 4. mutate price

indexagainst suchbase; - Step 5. ungroup data

- Step 6. select variables

date,var,priceandindex

# p_index <-

# p_lg %>%

# ________() %>% # step 1.

# ______( # step 2.

# base_part =

# ifelse(year(_____) == 2010, price, ____)

# ) %>%

# ______( # step 3.

# base = ______(_______, na.rm = TRUE)

# ) %>%

# mutate(index = ____ / _____ * 100) %>% # step 4.

# ungroup() %>% # step 5.

# select(date, var, price, index) # step 6.

#

# glimpse(p_index)Exercise 2. Plot time series of indexes for wheat and urea

Before plotting we need to filter var when it is %in% "wehat" or "urea";

Remember from the previous exercises: ggplot() + aes() + geom_path()

- Use

labs(x = "", y = "", title = "")to give meaningful labels to the plot.

# p_index %>%

# ______(var %in% c("wheat", ______)) %>%

# ______() +

# aes(x = _____, y = _______, colour = var) +

# geom_path() +

# labs()Answer the following questions:

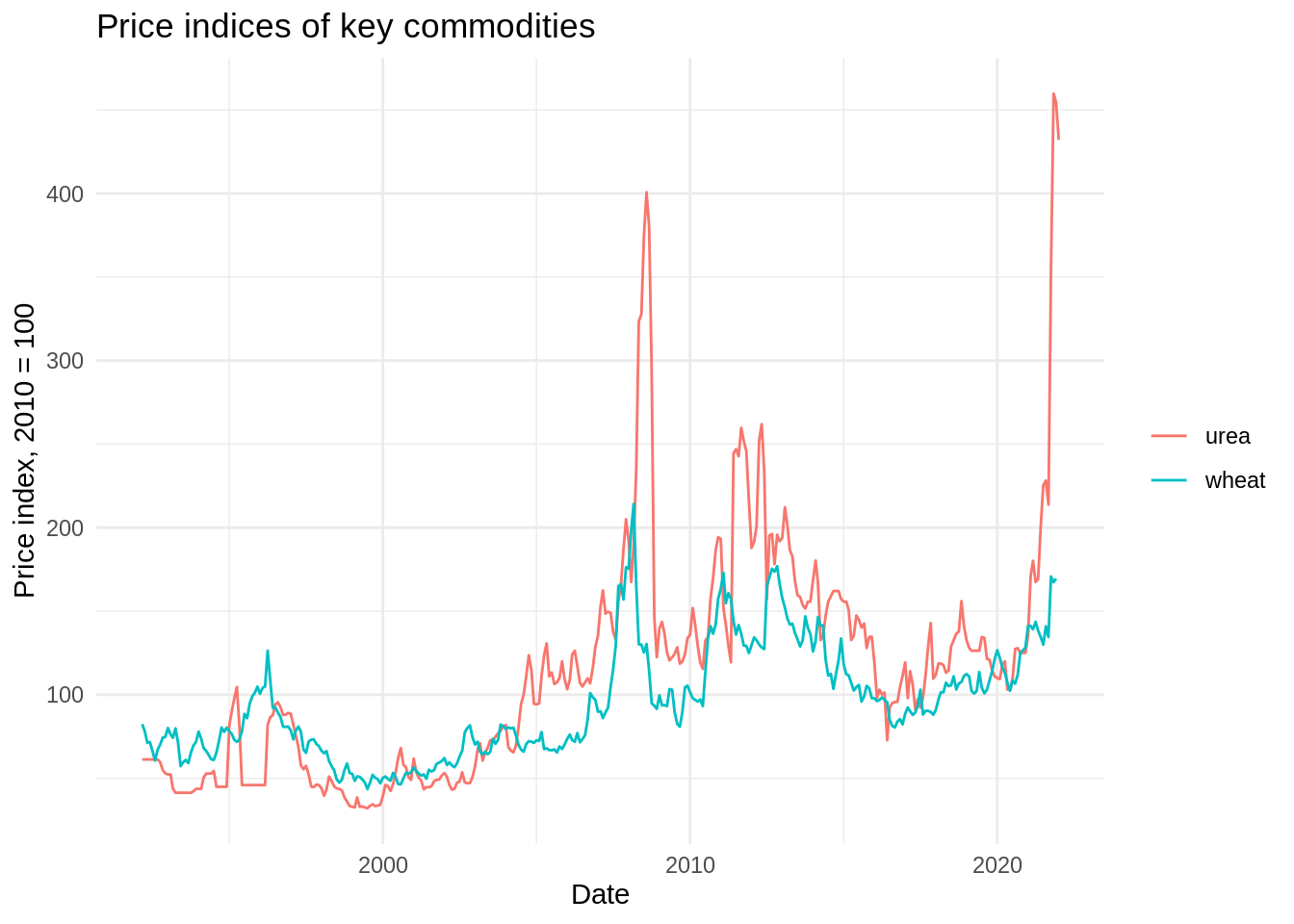

Can we conclude, based on the plot, that surging prices of

ureacause thewheatprices to surge?What could be a theoretical explanation for this?

What could be the theoretical mechanism of

ureaprices effect onwheat?

Exercise 3. Build a correlation table between price indices of different commodities

First, we need to convert our data to wide format again:

# p_index_wd <-

# p_index %>%

# pivot_wider(names_from = var, values_from = c(price, index))

# glimpse(p_index_wd)To make a correlation table, we use package correlation and a function with the same name. We use summary to convert correlation table with extensive results to a compact matrix

- We

selectonly those variables, where namescontains()stringindex.

library(correlation)

# p_index_wd %>%

# select(contains("index")) %>%

# correlation() %>%

# summary()

# p_index_wd %>%

# select(contains("price")) %>%

# correlation() %>%

# summary()- Does this correlation coefficients suggests about causation if we assume that theory does justifies causal relationship?

Run the same correlations but without summary(). What are the differences?

# p_index_wd %>%

# ______(_______("index")) %>%

# _________()

# ______ %>%

# ______(______("price")) %>%

# ______() Exercise 4. Compute a first difference of indices with lag 1

First difference is a change of value in the next period, compared to the previous one. To compute it, we use function lag() and perform similar mutate operations.

Simple example of a first difference

Before, we computed index in the following way:

p_lg_sb %>%

group_by(var) %>%

mutate(base = ifelse(month(date) == 1 & year(date) == 2010, price, NA)) %>%

tidyr::fill(base, .direction = "updown") %>%

mutate(index = price / base * 100)# A tibble: 10 × 5

# Groups: var [2]

date var price base index

<date> <chr> <dbl> <dbl> <dbl>

1 2010-01-01 maize 167. 167. 100

2 2010-02-01 maize 162. 167. 96.7

3 2010-03-01 maize 159. 167. 95.1

4 2010-04-01 maize 157. 167. 93.9

5 2010-05-01 maize 163. 167. 97.7

6 2010-01-01 wheat 199. 199. 100

7 2010-02-01 wheat 192. 199. 96.5

8 2010-03-01 wheat 190. 199. 95.6

9 2010-04-01 wheat 188. 199. 94.5

10 2010-05-01 wheat 190. 199. 95.7let us mutate() the index_fd variable:

p_lg_sb %>%

group_by(var) %>%

mutate(base = ifelse(month(date) == 1 & year(date) == 2010, price, NA)) %>%

tidyr::fill(base, .direction = "updown") %>%

mutate(index = price / base * 100) %>%

mutate(index_fd = index - lag(index))# A tibble: 10 × 6

# Groups: var [2]

date var price base index index_fd

<date> <chr> <dbl> <dbl> <dbl> <dbl>

1 2010-01-01 maize 167. 167. 100 NA

2 2010-02-01 maize 162. 167. 96.7 -3.29

3 2010-03-01 maize 159. 167. 95.1 -1.64

4 2010-04-01 maize 157. 167. 93.9 -1.18

5 2010-05-01 maize 163. 167. 97.7 3.77

6 2010-01-01 wheat 199. 199. 100 NA

7 2010-02-01 wheat 192. 199. 96.5 -3.51

8 2010-03-01 wheat 190. 199. 95.6 -0.926

9 2010-04-01 wheat 188. 199. 94.5 -1.11

10 2010-05-01 wheat 190. 199. 95.7 1.29 Using simple example, let us compute the first difference of the index for the entire data.

# p_index_fd <-

# ______ %>%

# group_by(______) %>%

# mutate(index_fd = ______ - lag(______)) %>%

# ungroup() %>%

# select(date, var, index_fd) %>%

# pivot_wider(names_from = var,

# values_from = c(index_fd))

#

# p_index_fd %>%

# glimpse()Exercise 5. Build a correlation table between first differences of indices for different commodities

As the same exercise before, we use correlation package and the same function.

# p_index_fd %>%

# correlation() %>%

# summary()Based on this results, does urea prices causes surges in the wheat prices?

What kind of causal relationship could be there?

Exercise 6. Compute first differences with lag 2 and 3

# p_index_fd_lags <-

# p_index %>%

# group_by(var) %>%

# mutate(fd = index - lag(index, 1)) %>%

# ungroup() %>%

# select(date, var, contains("fd")) %>%

# pivot_wider(names_from = var,

# values_from = c(contains("fd"))) %>%

# mutate(urea_fd1 = urea,

# urea_fd2 = lag(urea, 2),

# urea_fd3 = lag(urea, 3),

# urea_fd4 = lag(urea, 4),

# urea_fd5 = lag(urea, 5)

# )

#

# correlation(p_index_fd_lags) %>% summary()Solutions

p_wd <-

read_excel("data/commodity-prices.xlsx", sheet = "data") %>%

clean_names() %>%

rename(wheat = soft_red_winter_wheat_no_2_f_o_b_us_gulf_usd_per_mt,

maize = yellow_maize_no_2_f_o_b_us_gulf_usd_per_mt,

date = day_month_year,

oil = crude_oil_brent_usd_per_barrel,

urea = urea_f_o_b_black_sea_usd_per_mt) %>%

slice(-1) %>%

mutate(

oil = as.numeric(oil),

wheat = as.numeric(wheat),

maize = as.numeric(maize),

urea = as.numeric(urea),

date = convert_to_date(date)

)

p_lg <-

p_wd %>%

pivot_longer(cols = c(oil:urea),

names_to = "var",

values_to = "price") %>%

arrange(var, date)Ex. 1

p_index <-

p_lg %>%

group_by() %>% # step 1.

mutate( # step 2.

base_part =

ifelse(year(date) == 2010, price, NA)

) %>%

mutate( # step 3.

base = mean(base_part, na.rm = TRUE)

) %>%

mutate(index = price / base * 100) %>% # step 4.

ungroup() %>% # step 5.

select(date, var, price, index) # step 6.

glimpse(p_index)Rows: 1,436

Columns: 4

$ date <date> 1992-03-01, 1992-04-01, 1992-05-01, 1992-06-01, 1992-07-01, 199…

$ var <chr> "maize", "maize", "maize", "maize", "maize", "maize", "maize", "…

$ price <dbl> 117.00, 108.52, 109.64, 110.90, 102.75, 96.96, 98.05, 95.11, 94.…

$ index <dbl> 59.72918, 55.40009, 55.97185, 56.61509, 52.45447, 49.49864, 50.0…Ex. 2

p_index %>%

filter(var %in% c("wheat", "urea")) %>%

ggplot() +

aes(x = date, y = index, colour = var) +

geom_path() +

labs(x = "Date", y = "Price index, 2010 = 100",

title = "Price indices of key commodities",

colour = NULL)Warning: Removed 1 row(s) containing missing values (geom_path).

Ex. 3

p_index_wd <-

p_index %>%

pivot_wider(names_from = var, values_from = c(price, index))

library(correlation)

p_index_wd %>%

select(contains("index")) %>%

correlation() %>%

summary()# Correlation Matrix (pearson-method)

Parameter | index_wheat | index_urea | index_oil

--------------------------------------------------

index_maize | 0.89*** | 0.77*** | 0.81***

index_oil | 0.79*** | 0.80*** |

index_urea | 0.76*** | |

p-value adjustment method: Holm (1979)p_index_wd %>%

select(contains("price")) %>%

correlation() %>%

summary()# Correlation Matrix (pearson-method)

Parameter | price_wheat | price_urea | price_oil

--------------------------------------------------

price_maize | 0.89*** | 0.77*** | 0.81***

price_oil | 0.79*** | 0.80*** |

price_urea | 0.76*** | |

p-value adjustment method: Holm (1979)Ex. 4

p_index_fd <-

p_index %>%

group_by(var) %>%

mutate(index_fd = index - lag(index)) %>%

ungroup() %>%

select(date, var, index_fd) %>%

pivot_wider(names_from = var,

values_from = c(index_fd))